Unknown Facts About Fortitude Financial Group

Table of ContentsWhat Does Fortitude Financial Group Do?Fortitude Financial Group - The FactsThe 5-Second Trick For Fortitude Financial GroupThe 45-Second Trick For Fortitude Financial Group

With the right strategy in position, your money can go even more to aid the organizations whose missions are aligned with your worths. A monetary consultant can assist you define your charitable providing objectives and include them into your economic strategy. They can likewise recommend you in suitable methods to maximize your giving and tax obligation deductions.If your business is a partnership, you will certainly desire to go via the succession preparation procedure together - Financial Resources in St. Petersburg. An economic consultant can help you and your partners understand the crucial components in service sequence preparation, figure out the value of the company, produce shareholder arrangements, establish a payment structure for successors, outline shift alternatives, and a lot extra

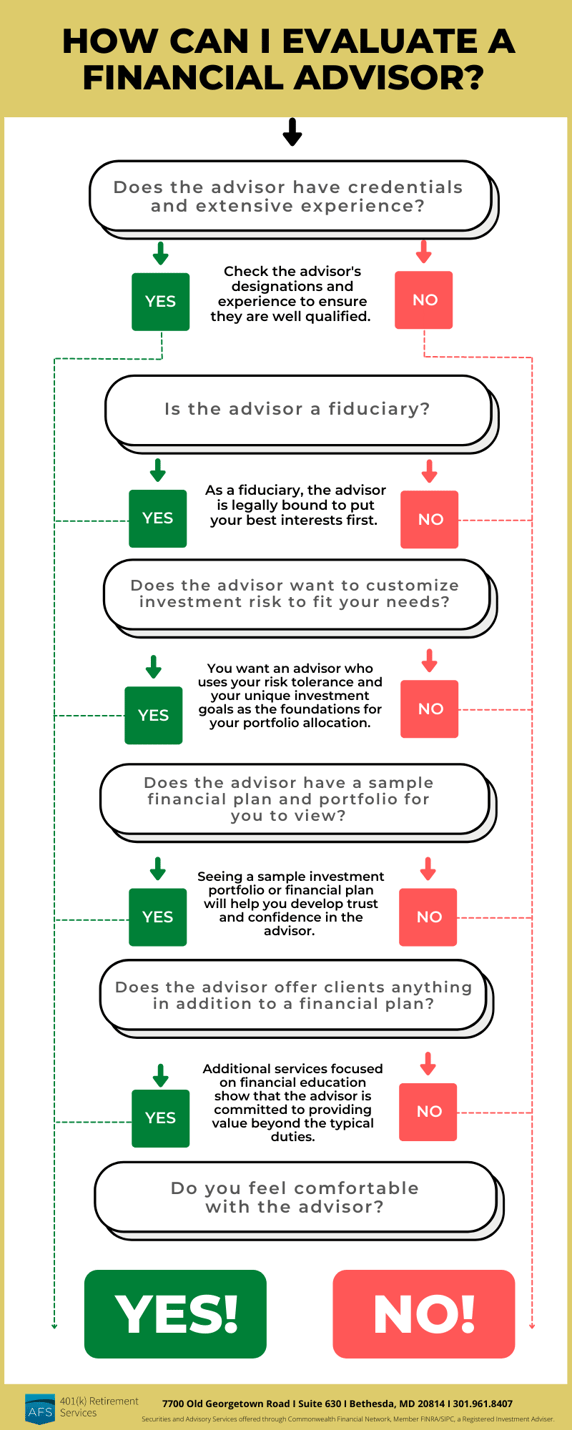

The trick is locating the ideal monetary expert for your circumstance; you may end up appealing different experts at different phases of your life. Try contacting your monetary organization for suggestions.

Unknown Facts About Fortitude Financial Group

Financial consultants assist you choose regarding what to do with your money. They direct their clients on saving for major purchases, placing cash apart for retirement, and investing cash for the future. They can additionally encourage on present economic and market task. Let's take a closer look at exactly what a monetary consultant does.

Advisors utilize their expertise and competence to build personalized financial plans that aim to accomplish the economic objectives of clients (https://www.storeboard.com/fortitudefinancialgroup1). These strategies consist of not just investments yet likewise financial savings, budget, insurance coverage, and tax methods. Advisors additionally check in with their customers regularly to re-evaluate their existing situation and plan as necessary

Rumored Buzz on Fortitude Financial Group

Let's say you desire to retire in twenty years or send your youngster to an exclusive university in ten years. To complete your objectives, you may require a proficient expert with the appropriate licenses to help make these plans a reality; this is where a monetary consultant can be found in (Financial Resources in St. Petersburg). With each other, you and your advisor will cover many subjects, consisting of the quantity look at this site of cash you need to save, the kinds of accounts you need, the type of insurance you ought to have (including long-lasting care, term life, impairment, etc), and estate and tax obligation preparation.

Financial experts give a variety of services to customers, whether that's supplying credible general investment guidance or helping within a financial objective like buying a college education fund. Listed below, discover a list of the most usual solutions offered by economic advisors.: A monetary advisor supplies recommendations on investments that fit your design, goals, and risk tolerance, developing and adjusting investing method as needed.: A monetary advisor develops methods to assist you pay your debt and stay clear of financial obligation in the future.: A monetary expert supplies pointers and techniques to create budget plans that help you meet your goals in the brief and the lengthy term.: Component of a budgeting method may consist of strategies that assist you pay for higher education.: Also, an economic consultant develops a saving plan crafted to your certain needs as you head right into retirement. https://allmyfaves.com/fortitudefg1?tab=Fortitude%20Financial%20Group.: A monetary advisor aids you identify individuals or companies you wish to obtain your legacy after you pass away and creates a plan to accomplish your wishes.: A financial consultant provides you with the most effective long-term options and insurance coverage options that fit your budget.: When it involves taxes, a financial expert may assist you prepare income tax return, make best use of tax reductions so you obtain one of the most out of the system, timetable tax-loss harvesting safety sales, make certain the very best usage of the resources gains tax rates, or plan to reduce tax obligations in retirement

On the set of questions, you will certainly likewise suggest future pensions and revenue sources, job retirement needs, and explain any kind of long-term monetary commitments. In other words, you'll list all present and anticipated financial investments, pensions, presents, and sources of income. The investing part of the survey touches upon more subjective topics, such as your risk tolerance and risk capability.

How Fortitude Financial Group can Save You Time, Stress, and Money.

At this factor, you'll also allow your consultant recognize your financial investment preferences. The first evaluation might likewise consist of an exam of other monetary management subjects, such as insurance coverage concerns and your tax situation.

Comments on “The smart Trick of Fortitude Financial Group That Nobody is Discussing”